All Categories

Featured

Table of Contents

Home mortgage life insurance policy offers near-universal coverage with very little underwriting. There is often no medical exam or blood example needed and can be an important insurance coverage option for any house owner with severe preexisting medical problems which, would stop them from purchasing conventional life insurance policy. Other benefits include: With a mortgage life insurance policy policy in position, successors will not need to fret or wonder what could occur to the household home.

With the home mortgage settled, the family members will always have an area to live, given they can pay for the building taxes and insurance policy every year. life home insurance.

There are a couple of different kinds of home loan protection insurance, these include:: as you pay even more off your mortgage, the quantity that the plan covers lowers in line with the outstanding equilibrium of your home mortgage. It is one of the most common and the most inexpensive type of home loan protection - what is the difference between homeowners insurance and mortgage insurance.: the quantity guaranteed and the costs you pay stays degree

This will pay off the home loan and any type of staying balance will go to your estate.: if you desire to, you can include major illness cover to your home loan protection plan. This suggests your home mortgage will be removed not just if you pass away, however additionally if you are diagnosed with a major disease that is covered by your plan.

Insurance That Pays Off Mortgage If I Die

Additionally, if there is a balance staying after the home mortgage is cleared, this will certainly go to your estate. If you change your home mortgage, there are a number of things to consider, depending upon whether you are covering up or expanding your home loan, changing, or paying the home mortgage off early. If you are topping up your home mortgage, you need to make certain that your policy meets the new value of your home mortgage.

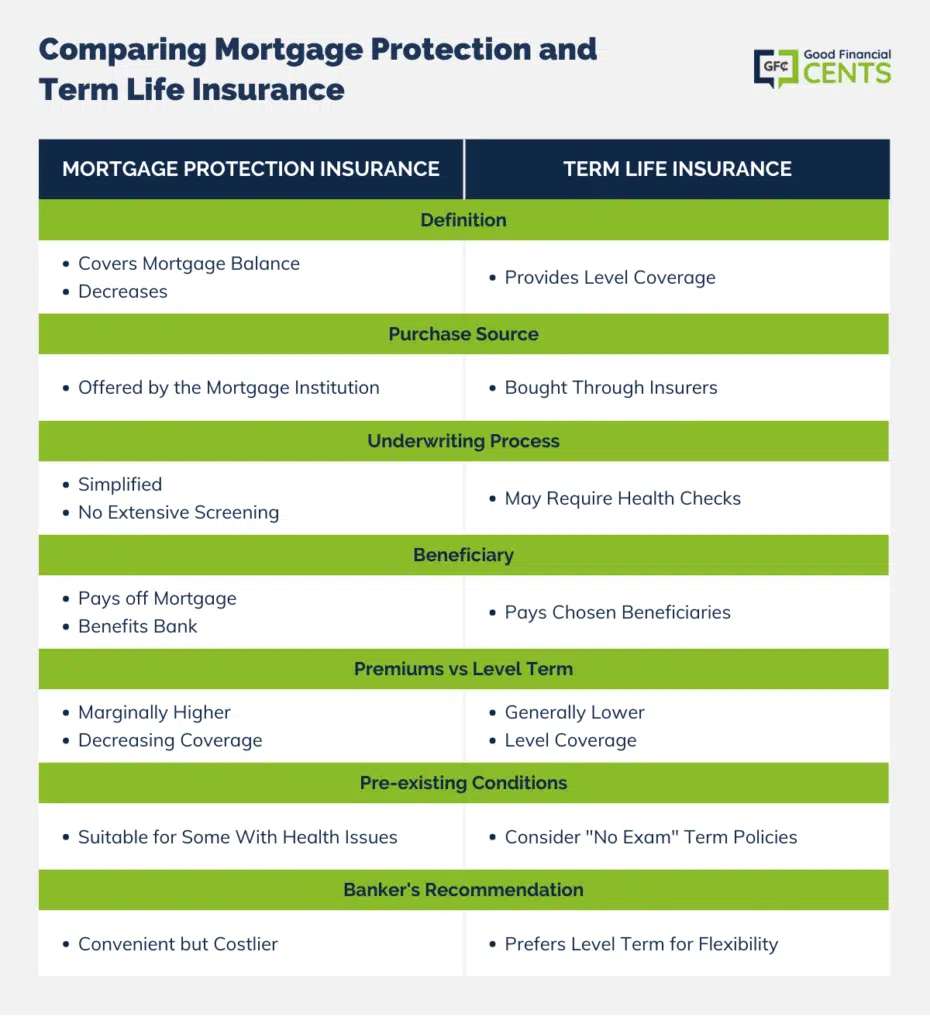

Compare the costs and advantages of both options (home loan protection plan vs term insurance). It might be more affordable to maintain your initial home loan protection policy and after that purchase a second policy for the top-up amount. Whether you are covering up your mortgage or expanding the term and require to get a brand-new plan, you might discover that your costs is greater than the last time you got cover

Usaa Mortgage Life Insurance

When switching your home mortgage, you can appoint your home loan security to the brand-new lending institution. The costs and degree of cover will coincide as prior to if the quantity you obtain, and the regard to your home loan does not transform. If you have a policy through your lending institution's group scheme, your loan provider will cancel the policy when you change your home loan.

In The golden state, mortgage defense insurance policy covers the entire exceptional balance of your loan. The death advantage is a quantity equal to the equilibrium of your mortgage at the time of your death.

House Payment Insurance

It's important to recognize that the death advantage is offered directly to your lender, not your loved ones. This guarantees that the continuing to be debt is paid completely which your loved ones are saved the financial strain. Home mortgage defense insurance coverage can likewise provide temporary coverage if you come to be impaired for an extensive duration (usually six months to a year).

There are numerous advantages to obtaining a mortgage security insurance policy in California. A few of the leading advantages include: Guaranteed authorization: Also if you remain in poor health or job in a hazardous profession, there is assured authorization with no clinical tests or laboratory tests. The exact same isn't true forever insurance.

Impairment protection: As specified above, some MPI plans make a few mortgage payments if you become impaired and can not generate the same earnings you were accustomed to. It is necessary to keep in mind that MPI, PMI, and MIP are all different kinds of insurance. Home mortgage protection insurance policy (MPI) is designed to pay off a home loan in instance of your death.

Mortgage Insurance

You can even apply online in mins and have your plan in position within the exact same day. For additional information concerning obtaining MPI coverage for your home loan, call Pronto Insurance coverage today! Our knowledgeable representatives are below to address any kind of inquiries you may have and give additional help.

It is a good idea to compare quotes from different insurance firms to discover the very best price and insurance coverage for your demands. MPI uses several benefits, such as satisfaction and streamlined credentials procedures. It has some constraints. The death advantage is directly paid to the lender, which limits versatility. Additionally, the advantage amount reduces over time, and MPI can be more pricey than conventional term life insurance plans.

Borrowers Protection Plan Mortgage Insurance

Go into standard information regarding yourself and your home loan, and we'll compare rates from different insurance firms. We'll also reveal you exactly how much protection you require to protect your home mortgage. Get begun today and give yourself and your family members the peace of mind that comes with knowing you're secured. At The Annuity Specialist, we understand house owners' core issue: ensuring their household can keep their home in the occasion of their death.

The major benefit here is quality and confidence in your decision, recognizing you have a plan that fits your requirements. As soon as you authorize the plan, we'll deal with all the documentation and arrangement, ensuring a smooth application procedure. The favorable result is the assurance that comes with knowing your family members is safeguarded and your home is safe, regardless of what takes place.

Specialist Advice: Guidance from experienced specialists in insurance policy and annuities. Hassle-Free Configuration: We manage all the paperwork and application. Cost-efficient Solutions: Discovering the very best protection at the most affordable feasible cost.: MPI specifically covers your mortgage, offering an additional layer of protection.: We function to find one of the most cost-efficient services tailored to your spending plan.

They can supply information on the insurance coverage and advantages that you have. On average, a healthy individual can expect to pay around $50 to $100 per month for mortgage life insurance coverage. It's suggested to obtain an individualized mortgage life insurance policy quote to get a precise estimate based on specific situations.

Latest Posts

Real Funeral Insurance Cost

Insurance For Burial

Buying Burial Insurance For Parents