All Categories

Featured

Table of Contents

- – What is Level Term Life Insurance Definition? ...

- – What is Life Insurance? Pros and Cons

- – What is 10-year Level Term Life Insurance? Im...

- – What Makes 20-year Level Term Life Insurance ...

- – What is 30-year Level Term Life Insurance? K...

- – What is Level Benefit Term Life Insurance? K...

- – What is Term Life Insurance Level Term? Your...

With this kind of degree term insurance plan, you pay the exact same monthly premium, and your recipient or recipients would certainly obtain the very same advantage in the event of your death, for the whole insurance coverage duration of the policy. So how does life insurance coverage operate in terms of expense? The expense of level term life insurance policy will rely on your age and wellness along with the term size and protection amount you pick.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Female$1,000,00030$43.3135 Male$500,00020$20.7235 Lady$750,00020$23.1340 Man$600,00015$22.8440 Female$800,00015$27.72 Estimate based on rates for qualified Place Simple candidates in exceptional health. No matter of what protection you choose, what the plan's cash worth is, or what the lump sum of the fatality advantage turns out to be, peace of mind is among the most beneficial advantages associated with buying a life insurance coverage plan.

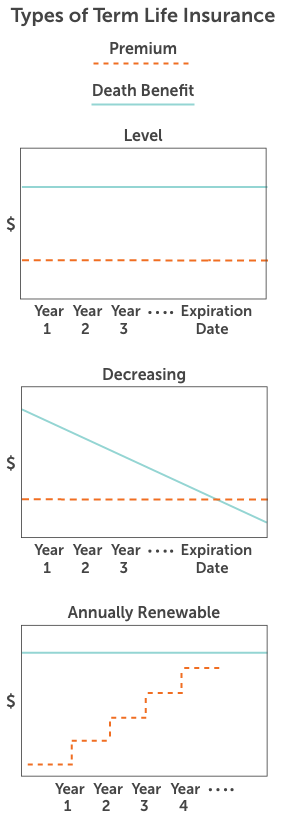

Why would certainly a person choose a policy with an each year renewable premium? It might be an alternative to take into consideration for someone that needs insurance coverage just momentarily. As an example, a person that is between jobs but wants survivor benefit security in position due to the fact that she or he has financial debt or various other economic obligations might wish to take into consideration a yearly sustainable policy or something to hold them over up until they start a brand-new task that provides life insurance.

What is Level Term Life Insurance Definition? Pros, Cons, and Considerations?

You can normally renew the policy every year which offers you time to consider your choices if you desire protection for much longer. That's why it's handy to buy the appropriate quantity and size of protection when you first obtain life insurance coverage, so you can have a low rate while you're young and healthy and balanced.

If you contribute essential unsettled labor to the household, such as childcare, ask on your own what it might set you back to cover that caretaking work if you were no longer there. Make certain you have that insurance coverage in place so that your household gets the life insurance policy benefit that they need.

What is Life Insurance? Pros and Cons

For that established amount of time, as long as you pay your premium, your rate is secure and your recipients are secured. Does that suggest you should constantly pick a 30-year term size? Not always. Generally, a much shorter term policy has a lower costs price than a longer policy, so it's clever to choose a term based upon the predicted size of your financial obligations.

These are all crucial factors to bear in mind if you were considering selecting a permanent life insurance policy such as a whole life insurance policy plan. Several life insurance plans provide you the option to include life insurance cyclists, believe additional benefits, to your policy. Some life insurance policies feature bikers built-in to the expense of costs, or bikers may be available at an expense, or have actually fees when worked out.

What is 10-year Level Term Life Insurance? Important Insights?

With term life insurance coverage, the interaction that the majority of people have with their life insurance policy business is a month-to-month expense for 10 to 30 years. You pay your month-to-month costs and wish your family will never need to utilize it. For the group at Place Life, that appeared like a missed out on chance.

We believe navigating choices about life insurance, your individual funds and total health can be refreshingly easy (Short Term Life Insurance). Our material is developed for academic functions just. Haven Life does not recommend the companies, products, services or methods gone over below, however we hope they can make your life a little much less hard if they are a fit for your circumstance

This material is not intended to offer, and need to not be counted on for tax, legal, or investment advice. Individuals are urged to seed recommendations from their very own tax obligation or legal advice. Learn More Haven Term is a Term Life Insurance Policy Plan (DTC and ICC17DTC in particular states, consisting of NC) issued by Massachusetts Mutual Life Insurance Firm (MassMutual), Springfield, MA 01111-0001 and offered exclusively with Place Life insurance policy Company, LLC.

The ranking is as of Aril 1, 2020 and is subject to transform. Haven Life And Also (Plus) is the advertising name for the And also motorcyclist, which is consisted of as component of the Place Term plan and supplies access to extra services and advantages at no expense or at a discount.

What Makes 20-year Level Term Life Insurance Different?

Learn more in this overview. If you rely on somebody economically, you could wonder if they have a life insurance policy plan. Find out exactly how to discover out.newsletter-msg-success,. newsletter-msg-error screen: none;.

When you're more youthful, term life insurance policy can be a simple way to shield your loved ones. As life changes your monetary top priorities can too, so you might want to have entire life insurance coverage for its lifetime protection and additional advantages that you can make use of while you're living. That's where a term conversion comes in.

What is 30-year Level Term Life Insurance? Key Points to Consider?

Authorization is assured no matter your health and wellness. The costs won't increase once they're established, but they will rise with age, so it's a great idea to lock them in early. Figure out a lot more concerning how a term conversion functions.

Words "degree" in the phrase "degree term insurance coverage" implies that this kind of insurance coverage has a set premium and face amount (fatality benefit) throughout the life of the plan. Put simply, when people chat concerning term life insurance coverage, they usually refer to level term life insurance policy. For the majority of individuals, it is the simplest and most budget-friendly selection of all life insurance policy types.

What is Level Benefit Term Life Insurance? Key Information for Policyholders

The word "term" right here describes a provided variety of years during which the degree term life insurance policy remains energetic. Degree term life insurance coverage is among one of the most preferred life insurance policy policies that life insurance coverage suppliers provide to their customers because of its simplicity and affordability. It is additionally simple to contrast degree term life insurance quotes and obtain the best costs.

The mechanism is as complies with: Firstly, choose a plan, fatality advantage amount and policy period (or term length). Choose to pay on either a monthly or yearly basis. If your premature demise happens within the life of the policy, your life insurer will certainly pay a round figure of fatality benefit to your determined recipients.

What is Term Life Insurance Level Term? Your Essential Questions Answered?

Your degree term life insurance policy policy expires when you come to the end of your policy's term. At this factor, you have the complying with choices: Option A: Keep without insurance. This option suits you when you can insure on your own and when you have no financial debts or dependents. Choice B: Buy a new level term life insurance policy policy.

1 Life Insurance Policy Data, Data And Market Trends 2024. 2 Price of insurance policy rates are established using methodologies that differ by firm. These prices can differ and will normally increase with age. Rates for energetic staff members may be different than those available to ended or retired staff members. It is very important to check out all elements when reviewing the general competition of rates and the worth of life insurance coverage.

Table of Contents

- – What is Level Term Life Insurance Definition? ...

- – What is Life Insurance? Pros and Cons

- – What is 10-year Level Term Life Insurance? Im...

- – What Makes 20-year Level Term Life Insurance ...

- – What is 30-year Level Term Life Insurance? K...

- – What is Level Benefit Term Life Insurance? K...

- – What is Term Life Insurance Level Term? Your...

Latest Posts

Real Funeral Insurance Cost

Insurance For Burial

Buying Burial Insurance For Parents

More

Latest Posts

Real Funeral Insurance Cost

Insurance For Burial

Buying Burial Insurance For Parents